Author: R&D Team, CUIGUAI Flavoring

Published by: Guangdong Unique Flavor Co., Ltd.

In the vape and e-liquid industry, flavor is the single most powerful element of brand identity. It’s what consumers remember between purchases, what they recommend to friends, and what drives loyalty in an environment where hardware differences are often incremental. A clear, consistent flavor identity — a reproducible sensory fingerprint across SKUs, devices, and markets — becomes a durable competitive advantage.

This technical, actionable guide explains how companies can design, validate, protect, and scale a flavor-based brand identity. It covers sensory science, analytical verification (GC–MS, headspace profiling, HPLC), device–flavor interactions, regulatory constraints, storytelling and packaging, supply-chain provenance, KPIs and governance, and a practical rollout roadmap. Throughout, we reference authoritative sources and real-world examples to make recommendations you can operationalize immediately.

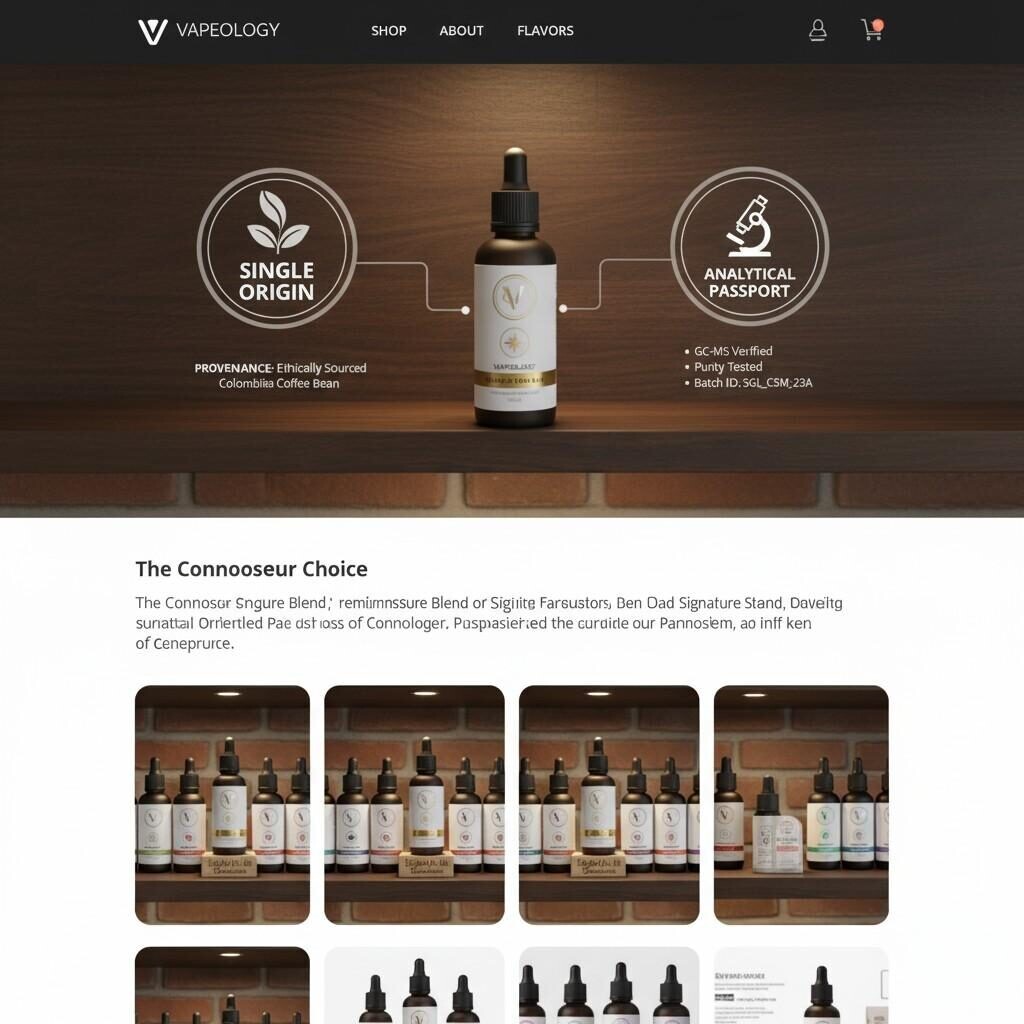

Premium E-Liquid Retail Display with Signature Flavor Highlight

Taste and aroma are tightly linked to memory and emotion: sensory cues trigger rapid brand recall in ways that visuals and copy sometimes cannot. Harvard Business Review notes that sensory branding — the deliberate use of sound, touch, smell and taste — deepens customer relationships and increases perceived value (HBR). (Source: Harvard Business Review.)

For vape brands, the relationship is stronger because the product is consumed repeatedly and often daily. A signature flavor can become shorthand for the brand — a user may say “I vape the [Brand] creamy tobacco” rather than citing hardware or nicotine strength. That shorthand translates into repeat purchase, premium positioning, and defendable market share.

Key outcomes of flavor-led identity:

A practical flavor identity is built from repeatable technical components:

These elements must be described both sensory-wise (language for panels and consumers) and analytically (compound lists and chromatographic markers).

Designing and institutionalizing a signature flavor involves a staged R&D process:

Define the brand personality (e.g., “modern classic,” “tropical explorer,” “craft dessert”). Identify sensory anchors and forbidden notes. Use market research to verify demand for the concept (Innova, Euromonitor or internal sales data).

Obtain GC–MS profiles of candidate ingredients and natural extracts. Identify aroma-active compounds (esters, terpenes, aldehydes) that will deliver the desired top, body and finish. Build a “golden lot” chromatogram to serve as the acceptance reference.

Formulate prototypes in the target PG/VG ratios and nicotine matrices. Evaluate volatility, solubility, and reaction risk under heat (pasteurization) or storage conditions.

Test prototypes across representative hardware. Document coil residue, dry-hit susceptibility, throat-hit, vapor density and coil life in defined protocols.

Run both trained panel mappings and consumer monadic tests. Define the hedonic thresholds for acceptance and the attribute intensities required to keep the identity consistent.

Finalize the GC–MS fingerprint, COA, and headspace release profile. Produce a micro-pilot (1–10 kg) to confirm scale behavior and create regulatory dossiers.

An analytical passport is non-negotiable for a robust flavor identity. At a minimum, every signature flavor should include:

The Institute of Food Technologists and industry analytical standards emphasize GC–MS fingerprinting as the backbone of flavor verification; it transforms subjective sensory judgments into objective, traceable metrics. (Source: Institute of Food Technologists.)

Use these passports: (a) during supplier qualification; (b) in panel regressions; (c) as legal evidence in disputes; (d) in PMTA/TPD dossiers where applicable.

Flavor perception in vaping is the co-product of the flavor compound and the delivery system. Device variables that materially affect identity include:

Practical implication: define and lock a canonical device matrix when certifying signature flavors. If a brand markets across multiple hardware types, document device-specific formulation variants and acceptance gates.

To convert a sensory concept into a marketable identity, use a combination of:

12–15 trained panelists map intensity across defined attributes (top note, mid note, sweetness balance, bitterness, cooling, aftertaste length). Use consensus lexicon and anchor references.

250–500 target consumers per major market segment for hedonic and purchase intent metrics. Monadic testing reduces contrast bias and delivers practical market signals.

Use digital monadic platforms or in-app tasting trials for early screening. These are lower fidelity than in-lab but accelerate iteration.

Correlate GC–MS marker intensities with sensory attributes using chemometrics (PCA, PLS regression). This reduces iteration cycles and permits predictive adjustments.

Metrics to track: Overall liking (9-point hedonic), attribute intensity (0–10), purchase intent (%), repurchase intent (%), and coil-life impact (hours/puffs).

GC-MS Chromatogram: Flavor Identity Analysis in the Lab

Regulations shape identity. Two important frameworks:

Practical steps:

Flavor identity is reinforced by visual and verbal cues:

Communicate provenance and process (e.g., “cold-pressed citrus oils,” “patented encapsulation for long release”) — but ensure claims are supported analytically and legally.

Brand identity depends on consistent raw materials:

Adulteration or lot variance at the botanical source will immediately affect identity. Use isotopic or marker analyses when dealing with high-value botanicals.

Create a simple dashboard to track brand identity health across markets and SKUs:

Review these KPIs in a monthly cross-functional “Flavor Stewardship” meeting (R&D, QA, Supply, Brand, Legal).

Pilot phase (1–10 kg): Confirm that analytical fingerprints and sensory performance translate at small scale. Pay attention to manufacturing parameters (shear, temperature) that may alter volatile retention.

Scale phase (100s kg+): Rely on process control charts (e.g., critical aroma compound potency vs batch) and mandatory lot sampling. Implement release gates tied to GC–MS similarity and sensory spot checks.

Ongoing production: Keep a rolling archive of “golden lot” passports and require supplier notifications for any upstream change (>90 days notice recommended).

Sensory Panel E-Liquid Flavor Validation Across Devices

A brand created identity by focusing on a restrained tobacco body with a single vanilla caramel lift. They standardized on a GC–MS fingerprint and mandated identical formulation across pods and disposables. The result: strong cross-SKU recognition and fewer consumer complaints about mismatch.

Another brand built identity around a curated set of tropical fruit profiles sourced from specific regions. They used provenance storytelling, limited drops, and premium pricing. The brand invested in regional warehousing and dual sourcing to ensure continuity.

A brand combined mild botanical relaxants (allowed, non-therapeutic botanicals) with calming floral notes. Their identity is a hybrid: flavor plus subtle functional messaging. Regulatory and consumer perception management were critical to avoid implied medical claims.

Risk: Batch variability — Mitigate with strict lot release testing, supplier audits, and Golden Lot control limits.

Risk: Regulatory change — Maintain a regulatory watch function and test alternative formulations proactively.

Risk: Brand dilution from extensions — Create brand architecture rules: only attach core identifier to SKUs meeting identity thresholds.

Risk: Supply shock — Use safety stock, consignment, and prequalified alternative suppliers.

Days 0–30 — Strategic brief, consumer insights, and concept selection.

Days 30–60 — Analytical scouting, Golden Lot creation, and initial prototypes.

Days 60–90 — Device compatibility, pilot batches, sensory mapping, GC–MS correlation.

Days 90–120 — Pre-commercial pilots, regulatory prechecks, packaging and storytelling assets.

Days 120–180 — Scale production, release gates, launch plan and post-launch monitoring.

Parallelize regulatory and supply chain tasks to compress calendar time.

McKinsey and industry analyses show that investing in analytics and digital processes improves speed-to-market and reduces product failures — both essential for preserving flavor identity during growth. (Source: McKinsey & Company.)

Set escalation rules: if identity drift > threshold, trigger manufacturing hold and root-cause.

Signature Flavor Product Page: Provenance & Analytical Passport

Regulatory frameworks (FDA PMTA, EU TPD) and analytical standards (IFT guidance) should be treated as constraints and accelerators: compliance processes imposed early reduce rework and protect identity in market.

Are you ready to craft and protect a flavor identity that becomes your brand’s most valuable asset? CUIGUAI Flavoring offers:

Contact CUIGUAI Flavoring today for a technical consultation or request a free signature flavor audit and sample kit tailored to your target device and market.

📩 [info@cuiguai.com]

📞 [+86 189 2926 7983]

🌐 Explore more at 【www.cuiguai.com】

The business scope includes licensed projects: food additive production. General projects: sales of food additives; manufacturing of daily chemical products; sales of daily chemical products; technical services, technology development, technical consultation, technology exchange, technology transfer, and technology promotion; biological feed research and development; industrial enzyme preparation research and development; cosmetics wholesale; domestic trading agency; sales of sanitary products and disposable medical supplies; retail of kitchenware, sanitary ware and daily sundries; sales of daily necessities; food sales (only sales of pre-packaged food).

Copyright ©Guangdong Unique Flavor Co., Ltd.All Rights Reserved. Privacy Policy